‹›Image and Signal ProcessingCompare Stock Prices Using DTW

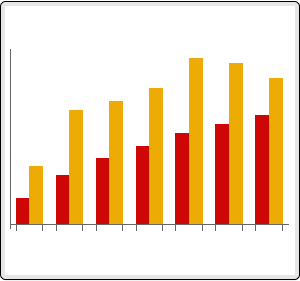

Use WarpingCorrespondence to compare the first quarter of 2016 of the HPQ stock prices with historical data from 2010 to 2015.

recent = FinancialData["HPQ", {{2016, 1, 1}, {2016, 3, 31}},

"Value"];

{histDates, hist} =

Transpose[

FinancialData["HPQ", {{2010, 1, 1}, {2015, 1, 31}}, "DateValue"]];Find the best matching subsequence of historical data.

{corrHist, corrRecent} =

WarpingCorrespondence[hist, recent,

Method -> {"MatchingInterval" -> "Flexible"}];Detect the historical interval most similar to quarter one of 2016.

{m, n} = corrHist[[{1, -1}]];

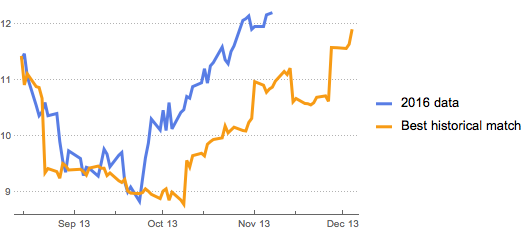

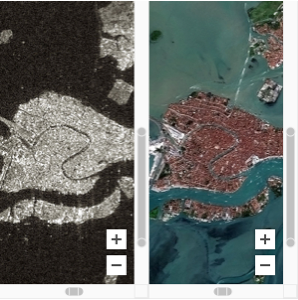

histDates[[{m, n}]]Visually compare recent data and the best historical match.

show complete Wolfram Language input

DateListPlot[{AssociationThread[

Take[histDates[[m ;; n]], Length[recent]], recent],

AssociationThread[histDates[[m ;; n]], hist[[m ;; n]]]},

PlotTheme -> "Business",

PlotLegends -> {"2016 data", "Best historical match"},

DateTicksFormat -> {"MonthNameShort", " ", "YearShort"},

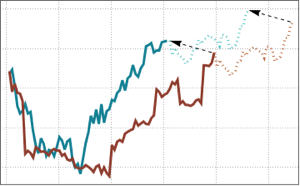

ImageSize -> Medium]Predict the stock prices for the next 30 days based on historical data.

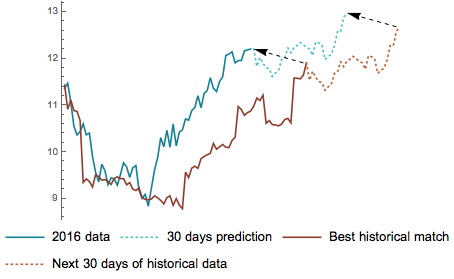

show complete Wolfram Language input

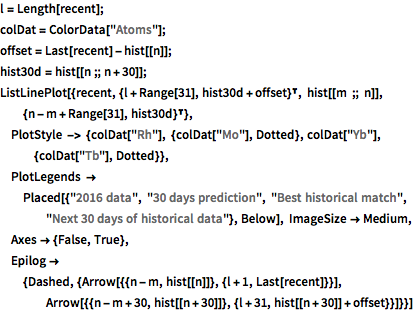

l = Length[recent];

colDat = ColorData["Atoms"];

offset = Last[recent] - hist[[n]];

hist30d = hist[[n ;; n + 30]];

ListLinePlot[{recent, {l + Range[31], hist30d + offset}\[Transpose],

hist[[m ;; n]], {n - m + Range[31], hist30d}\[Transpose]},

PlotStyle -> {colDat["Rh"], {colDat["Mo"], Dotted},

colDat["Yb"], {colDat["Tb"], Dotted}},

PlotLegends ->

Placed[{"2016 data", "30 days prediction", "Best historical match",

"Next 30 days of historical data"}, Below], ImageSize -> Medium,

Axes -> {False, True},

Epilog -> {Dashed, {Arrow[{{n - m, hist[[n]]}, {l + 1,

Last[recent]}}],

Arrow[{{n - m + 30, hist[[n + 30]]}, {l + 31,

hist[[n + 30]] + offset}}]}}]