Simulate Zero Coupon Bond Using Chen's Model

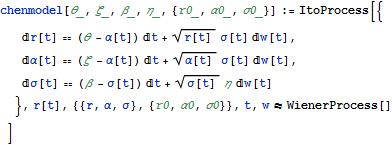

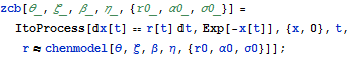

Define Chen's model for the evolution of interest rates.

| In[1]:= |  X |

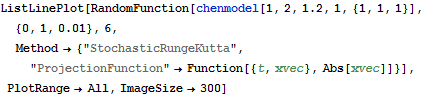

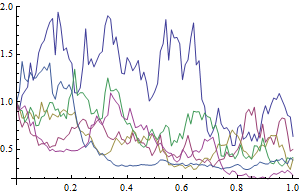

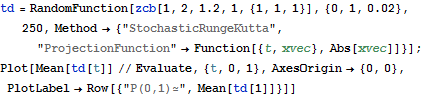

Visualize some trajectories using the stochastic Runge-Kutta method, correcting for negative interest rates that result from the use of the approximation.

| In[2]:= |  X |

| Out[2]= |  |

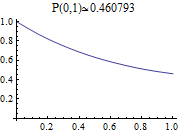

Evaluate zero-coupon bond maturing at time 1 using the Monte Carlo method. The present value of the bond is given by the mean of the process  .

.

| In[3]:= |  X |

| In[4]:= |  X |

| Out[4]= |  |