The Wolfram Solution forFinancial Engineering and MathematicsRapidly develop new models and deploy them to analysts and traders. Power front-to-back trading systems with instant computations. From exploring market behavior to managing portfolios, Wolfram Finance Platform provides state-of-the-art calculations and easy connectivity to databases and web services, as well as high-performance computing with built-in parallel processing that can be scaled to grids of any size. |

|

Wolfram Finance Platform includes thousands of built-in functions that let you:

- Search for patterns in past data or predict future market movements by developing algorithms and deploying them as tools for traders

- Rapidly prototype products and trading strategies for the world's largest market maker in Eurodollar derivatives

- Access your Bloomberg feeds and link to other data and applications with built-in connectivity tools

- Develop new theories to explain market efficiency

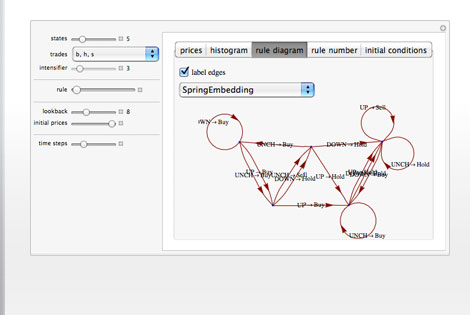

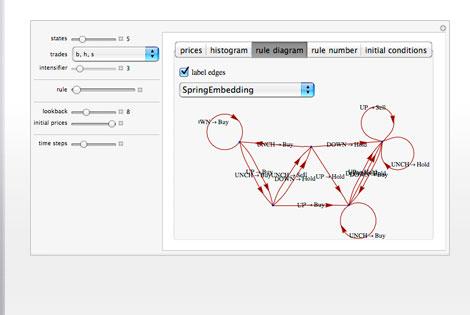

- Build artificial markets to model agent behavior

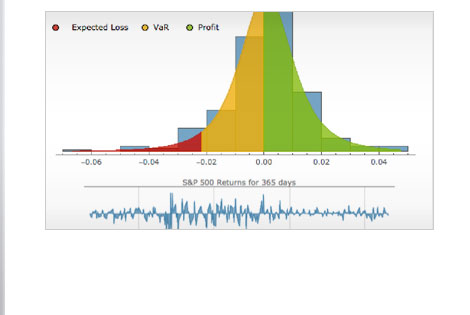

- Ensure accuracy by back testing trading strategies and stress testing product models

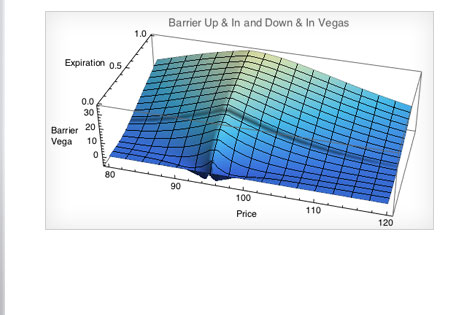

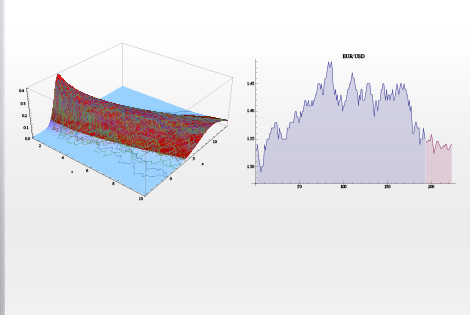

- Apply new mathematical tools to the pricing and hedging of derivative instruments

- Immediately deploy applications to traders based on analysts' findings

- Develop new models for options and determine optimal asset prices

- Use neural networks and genetic algorithms to create evolving agents for market models

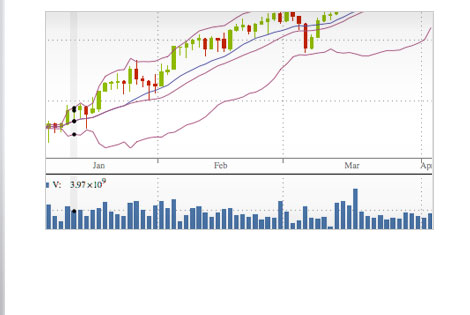

- Perform instant analysis on real-time trading data

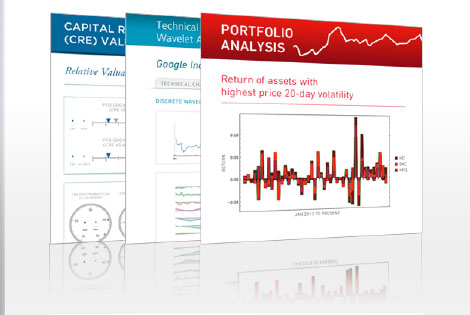

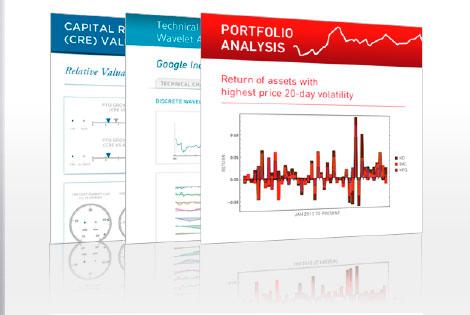

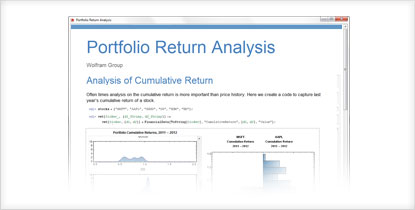

Make every report or statement interactive with real-time computation, enabling customers to test multidimensional "what if" scenarios

Use a rapid development workflow for computation-centric applications

Does your current tool set have these advantages?

-

Powerful symbolic statistical computation and built-in functions for all standard statistical distributions

Advanced symbolic computational capabilities are unique to Mathematica -

Fully automated precision control and arbitrary-precision arithmetic avoid the errors of traditional numeric systems

Excel, MATLAB, and other systems relying on machine arithmetic can show critical errors due to numerical accuracy failure -

Gain accuracy and reliability by performing symbolic calculations, not just numeric ones

MATLAB's and Java's built-in routines only handle numeric calculations -

Choose from procedural, functional, and rule-based programming paradigms as needed for fast development and deployment

Other computation environments use predominantly procedural languages -

Symbolic capabilities of time-value and bond functions allow for seamless integration with Wolfram Finance Platform's statistics framework for use in financial computations involving uncertain outcomes

Other systems require the purchase of add-ons to add functionality -

Having an integrated environment streamlines development, analysis, documentation, and delivery of custom financial models

Traditional programming languages like C/C++ don't have all the built-in computations and capabilities of Mathematica

Keep all elements of a project—calculations, visualizations, data, documentation, and even interactive applications—together, in uniquely flexible computable documents

Instantly create interactive tools that use built-in financial derivative computations

Wolfram Finance Platform includes thousands of built-in functions for financial computation, modeling, visualization, development, and deployment, including:

- Immediate computation on streaming data from Bloomberg »

- Comprehensive derivative calculations, including American, European, and exotic derivative pricing; Greeks; and implied volatility »

- Symbolic and numeric time-value-of-money computations including valuation of lump-sum amounts, annuities, and continuous or discrete cashflow streams »

- Calculation of effective interest rates for continuous- or discrete-time processes and term structures »

- Bond computation functions for values, sensitivity measures, accrued interest, and calendar measurements using continuous- and discrete-time coupon or interest rate processes and term structures »

- Built-in financial data, including current and historic market data, plus programmatic and interactive access to financial and economic data from Wolfram|Alpha

- Instant interactive financial charts, with more than 100 built-in financial indicators available for display »

- Automated report creation, PDF export, and interactive deployment with Wolfram CDF Player or webMathematica to deliver results to management or clients

- Built-in standard probability distributions, including distributions based on data or other distributions, and statistical analysis tools »

- The most advanced symbolic and numeric calculus system, including numeric integration and differential equation solving »

- A comprehensive system for discrete calculus, including difference equations, generating functions, and sequence visualization »

- Seamless integration of R, C, and C++ code into your workflow.

- Advanced IDE for a rapid development workflow for computation-centric applications »

- Support for GPU computing and built-in parallel processing that can be easily scaled up to a full grid for enterprise solutions

- Integrated random processes, signal processing, and graphs and networks functionality

- Efficient random number generation for Markov chain Monte Carlo (MCMC) techniques »

- Import and export all common data formats, including XML, XLS, CSV, and TSV, or use Mathematica Link for Excel to run Mathematica and Excel side-by-side

- Use highly customizable interactive gauges to convey spreadsheets' worth of information with a single glance »