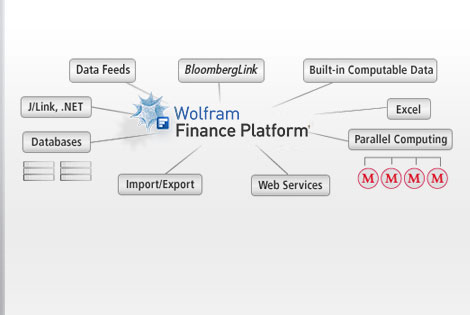

The Wolfram Solution forFinancial Risk ManagementRapidly develop and test robust financial risk models and deploy them as interactive applications or as high-performance infrastructure components—all from one system, with one integrated workflow. Wolfram Finance Platform is unique in offering the reliability of a mixed symbolic-numeric approach to computation, multiple switching algorithms, built-in computable financial and economic data, and integrated parallel computation for scaling up performance. |

|

Wolfram Finance Platform includes thousands of built-in functions that let you:

- Develop and refine analytic models for risk

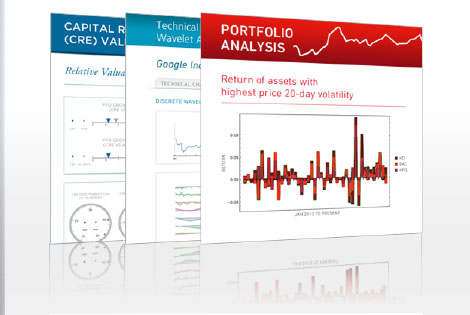

- Back-test trading strategies to check viability, or stress test models to account for extreme market changes

- Access real-time trading data and perform instant analysis

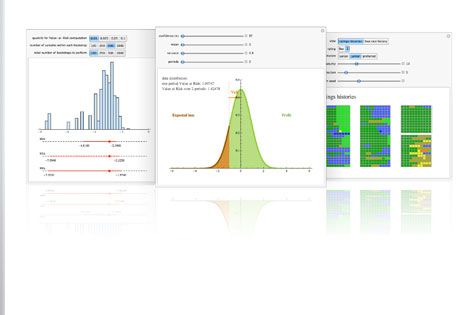

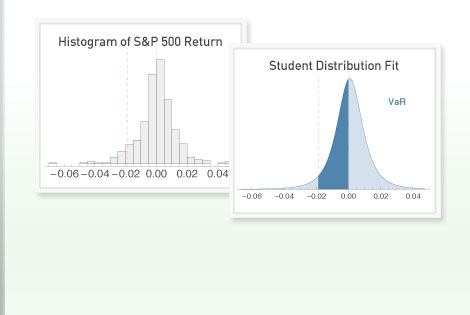

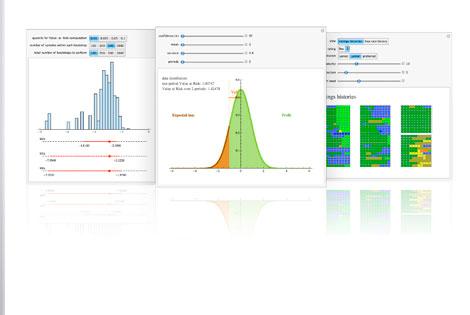

- Calculate value-at-risk for different portfolios and time horizons

- Do straight-through processing from the trade capture to the backend

- Create new tools for calculation, graphing, and modeling and deploy them to your website

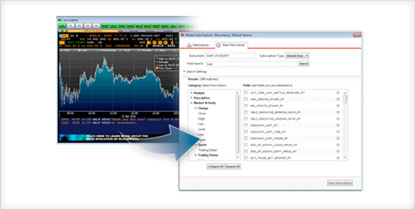

- Immediately compute with data from your existing Bloomberg feeds

- Dispatch order routing on .NET and Java platforms from one central command center

- Perform position reconciliation with online statements from the clearinghouse with XML functions

Easily flow live Bloomberg desktop data into any computation or visualization

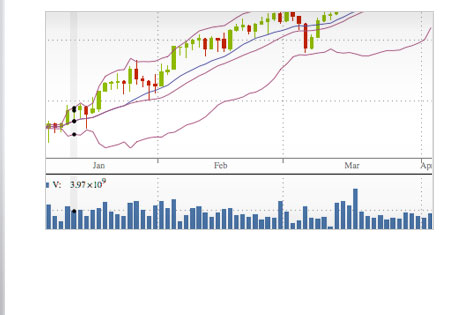

Instantly create sophisticated financial charts from built-in data feeds

Does your current tool set have these advantages?

- Symbolic capabilities of time-value and bond functions allow for seamless integration with Wolfram Finance Platform's statistics framework for use in financial computations involving uncertain outcomes

- Develop, analyze, test, document, and deliver custom models in a fraction of the time needed with other systems

-

Get accurate results with fully automated precision control and arbitrary-precision arithmetic

All systems relying on machine arithmetic, such as Excel or Matlab, become inaccurate -

Gain accuracy and reliability by performing symbolic calculations, not just numeric ones

Matlab's built-in routines only handle numeric calculations -

Choose from procedural, functional, and rule-based programming paradigms for fast development and deployment

Other computation environments use predominantly procedural languages

Present results in reports and slide shows containing interactive tools

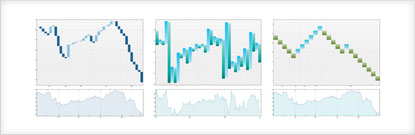

Use modernized versions of classic financial charts such as three-line break, point-figure, Renko, and Kagi charts

Wolfram Finance Platform includes thousands of built-in functions for financial computation, modeling, visualization, development, and deployment, including:

- Comprehensive derivative calculations, including American, European, and exotic derivative pricing, Greeks, and implied volatility »

- Immediate computation on streaming data from Bloomberg »

- Symbolic and numeric time-value-of-money computations, including valuation of lump-sum amounts, annuities, and continuous or discrete cashflow streams »

- Calculation of effective interest rates for continuous- or discrete-time processes and term structures »

- Bond computation functions for values, sensitivity measures, accrued interest, and calendar measurements using continuous- and discrete-time coupon or interest rate processes and term structures »

- Built-in statistical analysis and probability distributions, including stable and hyperbolic distributions, plus the ability to create distributions from data or other distributions »

- State-of-the-art data visualization with scaling functions; paired bar charts and histograms; and finance-specific charts like candlestick, point and figure, Kagi, and more »

- Immediately create highly customized interactive financial charts using 100 built-in financial indicators »

- Integrated GPU computation, with CUDA and OpenCL support, and external dynamic libraries for fast, efficient execution

- Built-in financial data, including current and historic market data, plus programmatic and interactive access to financial and economic data from Wolfram|Alpha

- Automated report creation, PDF export, and interactive deployment with Wolfram CDF Player or webMathematica to deliver results to management or clients

- Seamless integration of R, C, and C++ code into your workflow.

- Advanced IDE for a rapid development workflow for computation-centric applications »

- Integrated random processes, signal processing, and graphs and networks functionality

- Efficient random number generation for Markov chain Monte Carlo (MCMC) techniques »

- Import and export all common data formats, including XML, XLS, CSV, and TSV, or use Mathematica Link for Excel to run Mathematica and Excel side by side

- Use highly customizable interactive gauges to convey spreadsheets' worth of information with a single glance »