Get started with Wolfram technologies, or work with us to apply computational expertise to your projects.

Questions? Comments? Get in touch: 1-800-WOLFRAM, or email us

Now, more than ever, financial computation involves more than pure number crunching, and the new financial leaders are looking to Mathematica for help.

Investment houses regularly "slice and dice" securities such as mortgages, government bonds, and even junk bonds to meet specific risk/return objectives. While spreadsheet programs and C/C++ remain useful, symbolic programming languages--i.e., languages that manipulate both the numbers and the symbols that represent the financial structures--are increasingly needed to deal with the increasing complexity of the financial world.

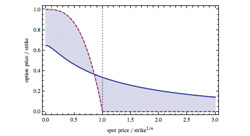

Dr. Ross Miller,1 one of the first to take a symbolic approach to financial analysis, used Mathematica to create a relatively simple model that is traditionally numerical in nature: the Black-Scholes option pricing model.

"Mathematica makes it possible to manipulate the Black-Scholes pricing formula directly as a symbolic entity. This greatly simplifies computing the various risk characteristics of an option--a task that is both tedious and error-prone when performed in a more traditional manner--and facilitates extensions of the model that are made 'on the fly.'"

Mathematica then helped pick up where the Black-Scholes option pricing model left off. Although the Black-Scholes model gives a closed-form solution for pricing European options, many other options cannot be priced by this model. Such options include American options and options whose terminal payoffs are dependent on the path followed by the stock price. Using the binary and binomial option pricing models and the Monte Carlo method, three financial engineers2 used Mathematica to price such options.

"Without Mathematica, others have had to use approximations to pricing formulas for options that are difficult to price. Mathematica enabled us to price many of these options directly."

1. Dr. Ross Miller is the author of the book Computer-Aided Financial Analysis and has published several journal articles on information transfer in financial markets and on the design of advanced electronic market systems. He was the head of research for the National Westminster Bank and served as a member of the technical staff of the General Electric Corporate Research and Development Center before starting his own consulting company specializing in investment and risk management.

2. Simon Benninga, Raz Steinmetz, and John Stroughair. Dr. Benninga is the author of Numerical Methods in Finance, and his research interests include options and futures markets. Raz Steinmetz and John Stroughair were graduate students at the Wharton School of the University of Pennsylvania when this research was conducted.