Model Differences in Log Returns of Stock Prices

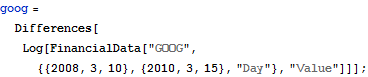

Consider differences in log returns for Google stocks.

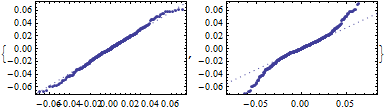

| In[1]:= |  X |

Fit a TsallisQGaussianDistribution to the data and compare against the fit with a NormalDistribution.

| In[2]:= | X |

| Out[2]= |

| In[3]:= | X |

| Out[3]= |

| In[4]:= | X |

| Out[4]= |

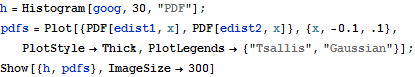

Compare a histogram of the data to the PDF of the fitted distributions.

| In[5]:= |  X |

| Out[5]= |  |

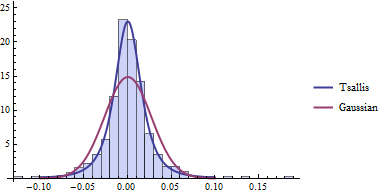

Inspect the heavy-tail behavior.

| In[6]:= | X |

| Out[6]= |  |

Find the probability of the log-return to exceed 0.10.

| In[7]:= | X |

| Out[7]= |

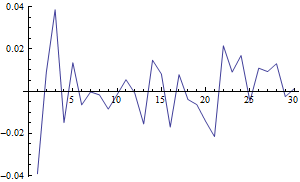

Simulate the log difference in price for 30 consecutive days.

| In[8]:= | X |

| Out[8]= |  |