Use Time Series Processing for Financial Analysis

The Calmar ratio is used to evaluate the performance of hedge funds and commodity trading advisors. It is defined as the ratio of annualized return over maximum drawdown. Higher Calmar ratio indicates better performance of an investment strategy.

The data contains date-value pairs of multivariate data consisting of Open, High, Low, Close, Adj Close and Volume values for SP500. Use this data to show how to compute the Calmar ratio and then how to construct a rolling Calmar ratio.

Create a multivariate TimeSeries defining component names for easy extraction using the option "ComponentNames" within MetaInformation.

Retrieve the property "MetaInformation".

Extract the adjusted closing price using the "Adj Close" component from the preceding time series.

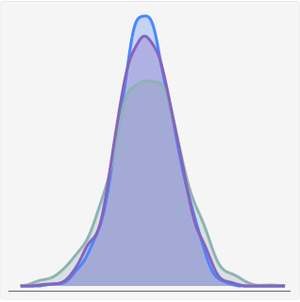

Compute simple returns and cumulative simple returns using daily prices.

Compute geometric mean return and annualized return using a 252-scale factor that corresponds to the number of business day in a year.

Use TimeSeriesMap to compute the running maximum price.

Compute the relative drawdown and maximum relative drawdown.

Compute the Calmar ratio using annualized return and maximum relative drawdown.

Now put all these steps together and define a function for computing the Calmar ratio, to be used to compute a rolling Calmar ratio.

Compute the rolling Calmar ratio over a three-year period using MovingMap and the function iCalmarRatio defined in the preceding example.

Visualize cumulative returns, relative drawdown and rolling Calmar ratio.