Core Algorithms

Use Stable Distribution to Model Stock Prices

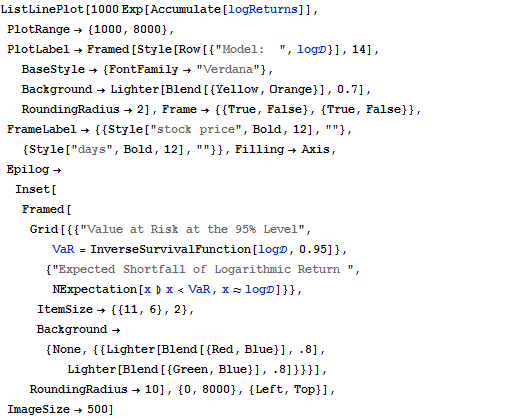

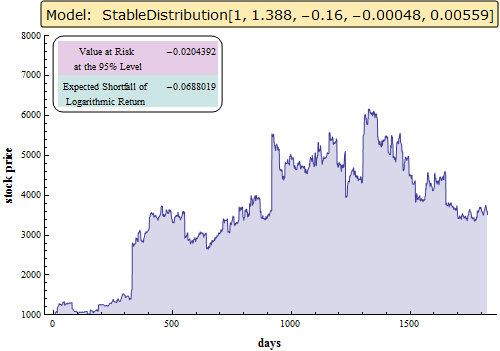

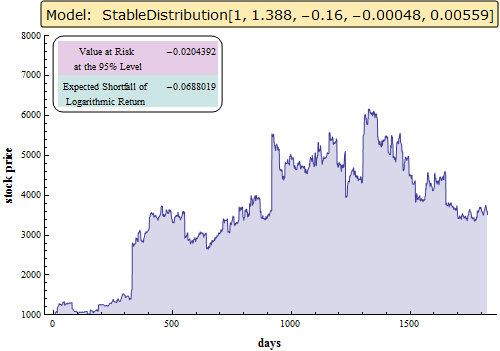

Assuming daily logarithmic return of the stock market follows a stable distribution, simulate and visualize stock prices over a period of five years.

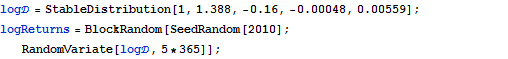

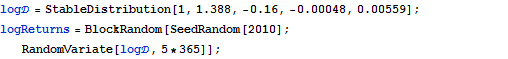

| In[1]:= |  X |

| In[2]:= |  X |

| Out[2]= |  |

| New in Wolfram Mathematica 8: Parametric Probability Distributions | ◄ previous | next ► |

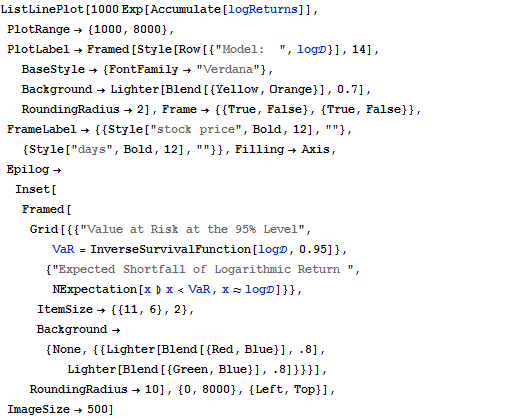

| In[1]:= |  X |

| In[2]:= |  X |

| Out[2]= |  |