One Hundred Times Faster: Using Mathematica to Teach Local Volatility

Jose Luu, Natixis

This page requires that JavaScript be enabled in your browser.

Learn how »

- Run fast, efficient large-scale simulations

- Instantly create interactive applications to study economic behavior

- Detect and visualize chaotic behavior in macroeconomic time-series data

Challenge

As an investment banker at Natixis who runs an internal workshop called BFI Campus, Jose Luu needs a way to teach the difficult concept of local volatility. To approach the topic using only traditional math presents a huge obstacle, because the details of the calculations get in the way of subject comprehension.

Solution

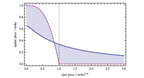

Luu's session, titled "Local Volatility without Math," uses Mathematica to demonstrate the concept of local volatility via the Monte Carlo methods. Mathematica handles all the calculations, making it much faster to compile and execute results.

Benefits

Mathematica makes it possible for students to focus on the concept at hand by completing calculation-heavy tasks that distract from their understanding of local volatility. Dynamic graphs and models make lessons interactive for even better comprehension.