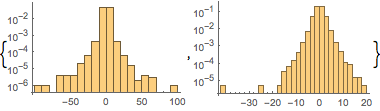

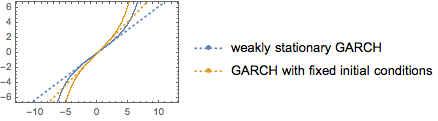

Slice Distribution of GARCH(1,1)

Generalized autoregressive conditionally heteroscedastic process GARCHProcess is used to describe time series that exhibit volatility clustering phenomenon. The distribution of the time slice of a GARCH process has much heavier tails than the normal distribution. These two properties make GARCH process a very attractive choice to model financial time series, which display both of these phenomena.

Define a weakly stationary GARCHProcess.

| In[1]:= | X |

Define a GARCHProcess with fixed initial value.

| In[2]:= | X |

Simulate random samples from each process sliced at time 3.

| In[3]:= | X |

Visualize sharply peaked probability density functions from data in the log scale.

| In[4]:= | X |

| Out[4]= |  |

Compare to a NormalDistribution.

| In[5]:= |  X |

| Out[5]= |  |