Use Vector Models with Multiple Strongly Correlated Time Series

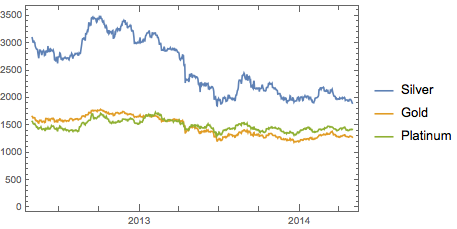

The prices of precious metals are strongly correlated. Analyze vector of prices for silver, gold, and platinum, with silver prices multiplied by 100, from May 1, 2012 to May 1, 2014.

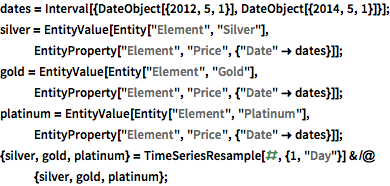

| In[3]:= | X |

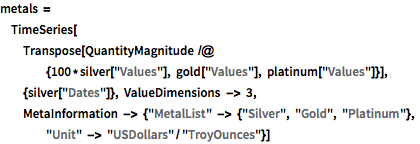

| In[4]:= | X |

| Out[4]= |  |

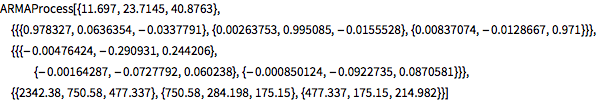

Fit an ARMAProcess to the data.

| In[5]:= | X |

| Out[5]= |  |

The model is weakly stationary and invertible.

| In[6]:= | X |

| Out[6]= |

| In[7]:= | X |

| Out[7]= |

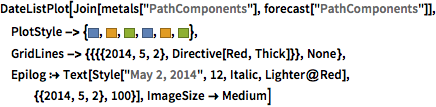

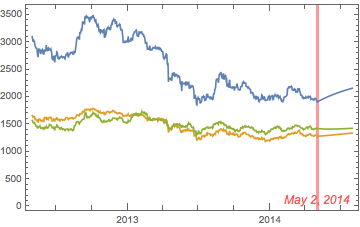

Find forecast for the next 90 days.

| In[8]:= | X |

| Out[8]= |

| In[9]:= |  X |

| Out[9]= |  |